On better measuring gains in the standard of living

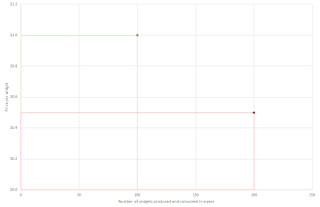

The main idea: the area under an assumed linear demand curve is a far better approximation of utility gains than current GDP accounting practices. 0. Posts on this blog are ranked in decreasing order of likeability to myself. This post was originally posted on 04.11.2021, and the current version may have been updated several times from its original form. 1 The Nominal 1.1 I was inspired to think of this when reading this post (h/t Astral Codex Ten ). All of the relevant critique of the post itself can be found in the comments, but it helped me realize there is something off with real GDP as a measure of standard of life. I will take the opposite view of Less Wrong though, and state that real GDP accounting overestimates gains in standard of life. 1.2 Let's take a simple economy that only produces and consumes widgets. I am not interested in nominal – real distinctions here, so I need not assume any more than one product class, and will stick to inflation not being a thi...