On a cryptocurrency of dynamic supply

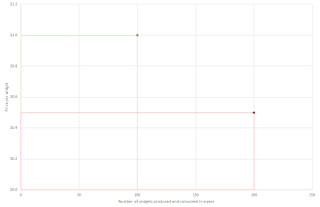

The main idea: two joint cryptocurrencies are programmed such that one can be exchanged for the other as long as their product remains constant, thus tracking the minimal necessary volume of circulation required by a growing economy in a decentralized fashion. 0. Posts on this blog are ranked in decreasing order of likeability to myself. This entry was originally posted on 30.09.2021, and the current version may have been updated several times from its original form. 1 The issue 1.1 The only credible challenger to the current system of a centralised issuer of currency would be a decentralised system under the auspices of cryptocurrency. Alas, most of the time, the designers of these ingenious tools just went with “fixed supply is good enough” and left it at that, making cryptocurrency a great store of value, but a shonky unit of account. And how much worse this issue becomes when the user base is growing faster than the global economy (which of course it does)! 1.2 I’ve earlier e...